Cryptocurrencies have come a long way since the inception of Bitcoin over a decade ago. In recent years, we’ve witnessed a surge in new cryptocurrencies, each with unique features and use cases. This article explores the innovative ways in which these new cryptocurrencies are being utilized to revolutionize various sectors and industries. In addition, you can find an investment education company to start your learning journey by visiting Immediate Flik.

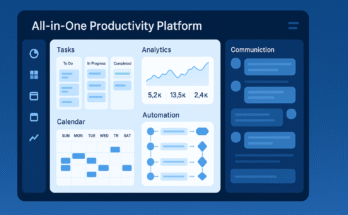

Decentralized Finance (DeFi) Revolution

Exploring DeFi and its Significance

Decentralized Finance, or DeFi, is a groundbreaking use case for cryptocurrencies that aims to recreate traditional financial services on a blockchain. DeFi platforms facilitate lending, borrowing, trading, and earning interest without the need for intermediaries like banks. They operate on smart contracts, enabling automated and transparent financial transactions.

Examples of DeFi Projects and Their Impact

Projects like Compound, Aave, and MakerDAO have gained prominence, allowing users to earn interest by lending their assets or borrowing funds without the involvement of banks. These platforms have the potential to provide financial services to unbanked populations globally.

Benefits and Challenges of DeFi

DeFi offers financial inclusivity, lower fees, and faster transactions. However, it also faces challenges like smart contract vulnerabilities and regulatory concerns. Balancing innovation with security and compliance remains a constant challenge.

Future Potential of DeFi in the Financial Sector

The growth of DeFi is poised to disrupt traditional financial institutions and foster financial democratization. The future might witness DeFi platforms integrating with traditional finance to provide a seamless user experience.

Tokenization of Real-world Assets

Tokenizing Real Estate and its Advantages

Tokenization allows real estate assets to be divided into smaller, more accessible shares. This opens up real estate investment to a broader audience, reduces transaction costs, and increases liquidity.

Tokenized Ownership in Art and Luxury Assets

Ownership of high-value assets like art, luxury cars, and fine wine can be fractionalized through tokens, allowing multiple investors to share ownership. This democratizes access to luxury markets.

Challenges and Regulatory Hurdles in Asset Tokenization

Regulatory challenges and legal complexities vary by jurisdiction. Ensuring compliance with securities laws and protecting investors’ rights are critical concerns in asset tokenization.

Potential Impact on Traditional Markets

The integration of blockchain and tokenization can disrupt traditional financial markets, providing efficient and transparent ways to trade and invest in real-world assets.

Decentralized Autonomous Organizations (DAOs)

Understanding DAOs and Their Structure

Decentralized Autonomous Organizations (DAOs) are organizations governed by smart contracts and the consensus of their members. They eliminate the need for centralized management and decision-making.

How DAOs are Being Used for Governance

DAOs have been used for decentralized governance in blockchain projects, enabling community-driven decisions. They can potentially expand into other sectors like companies, cooperatives, and even governments.

Risks and Vulnerabilities Associated with DAOs

DAOs are not without risks, as they can be vulnerable to attacks and exploitation. The 2016 “The DAO” hack serves as a cautionary tale, highlighting the need for robust security measures.

The Potential for DAOs to Revolutionize Decision-making

Despite risks, DAOs hold the promise of democratizing decision-making and increasing transparency in organizations, fostering a more equitable and participatory future.

Cross-Border Payments and Remittances

The Limitations of Traditional Cross-Border Transactions

Traditional cross-border transactions are often slow, expensive, and subject to intermediaries’ fees. Cryptocurrencies offer a faster and cheaper alternative.

Cryptocurrency’s Role in Reducing Remittance Costs

Cryptocurrencies like Bitcoin and stablecoins are being used to send remittances across borders with lower fees. This has the potential to benefit migrants and their families.

Case Studies of Successful Cross-Border Payment Solutions

Projects like Ripple’s XRP and Stellar have established themselves as efficient cross-border payment solutions, partnering with financial institutions to streamline international money transfers.

Regulatory Concerns and International Cooperation

Regulatory challenges surrounding cross-border payments need to be addressed for cryptocurrencies to gain widespread acceptance. International cooperation is crucial for developing effective regulatory frameworks.

Privacy Coins and Financial Privacy

Introduction to Privacy Coins

Privacy coins like Monero and Zcash are designed to enhance transaction privacy, making it difficult to trace the sender, receiver, and transaction amount.

Use Cases for Enhanced Financial Privacy

Privacy coins are used for privacy-focused transactions, protecting individuals from surveillance and preserving financial confidentiality.

Balancing Privacy with Regulatory Compliance

Privacy coins face scrutiny from regulators due to concerns about their potential misuse in illegal activities. Striking a balance between privacy and compliance remains a challenge.

Future Developments in Privacy-focused Cryptocurrencies

Privacy coins continue to evolve, with ongoing efforts to improve privacy features and address regulatory concerns.

Environmental Concerns and Sustainable Cryptocurrencies

The Environmental Impact of Cryptocurrency Mining

Proof-of-work cryptocurrencies, like Bitcoin, have faced criticism for their energy-intensive mining processes. Critics argue that this contributes to carbon emissions.

Initiatives for Sustainable Cryptocurrency Projects

Some cryptocurrencies are transitioning to more eco-friendly consensus mechanisms, like proof-of-stake, to reduce their environmental footprint.

Technological Innovations to Reduce Energy Consumption

Researchers and developers are actively working on improving blockchain scalability and efficiency to reduce energy consumption.

The Role of Cryptocurrencies in Promoting Sustainability

Cryptocurrencies can also be used to incentivize sustainable practices through token rewards and carbon offset initiatives.

Conclusion

Innovation in cryptocurrencies is rapidly reshaping industries, from finance to art and beyond. These new use cases offer exciting possibilities for the future. As the cryptocurrency landscape continues to evolve, it’s essential to monitor these developments and adapt to the changing financial and technological landscape.