Choosing the right insurance cover for your vehicle is a fundamental aspect. It involves a lot of considerations. Among these considerations is to choose between comprehensive and collision insurance coverage. So, why should you settle for comprehensive coverage? Why should you purchase collision coverage? Confused, right? Well, it’s normal. The following information contains the features of each coverage and how to determine the coverage that fits your four-wheeler. Keep reading to learn more!

How to Choose the Best Option

Comprehensive and basis based insurance are the two common types of policies available on the market. Both of these two types of insurance are instrumental when it comes to keeping your car on its top shape. Here is a breakdown of what to expect from each of these two types of insurance covers.

Read more: How Do You Become Scrum Certified?

Comprehensive Coverage

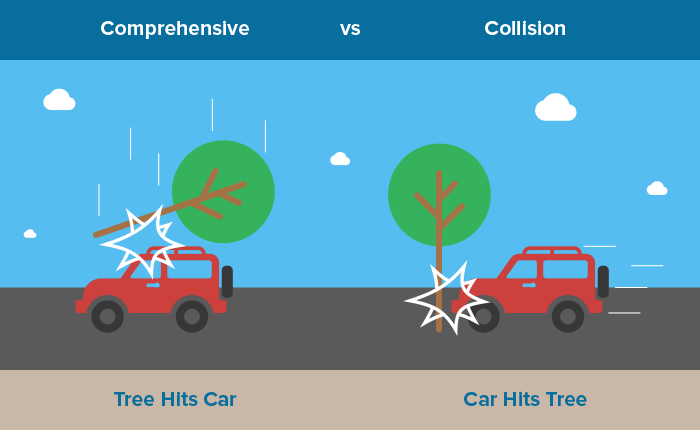

Any car can be vulnerable to losses or damages. Regardless of the type of road, you are using, you need an insurance cover to protect your car from damages and accidents. Of course, accidents are the biggest risks. It’s one of the most common reasons why people take insurance covers. However, extreme weather conditions like falling trees, monster-sized hail, as well as vandalism can also pose a big risk to your car.

So, if you love and value your car, get a comprehensive insurance cover. With this type of cover, you have an insurance policy that safeguards your vehicle against a myriad of risks—including vandalism, falling trees, extreme weather conditions, theft, accidents, among others. It shields you from incurring any financial burden in case any of these risks happen. The best part is that you can use it as a stand-alone cover or you can combine it with other policies. In most cases, comprehensive coverage it offers a reasonably priced coverage featuring low deductibles. Common features of this of an insurance policy include:

- Repairing damaged glass, windshield chips, and cracks

- Covering contact with different animals—especially the deer

- Providing protection against harsh weather conditions like storm, hail, and flood

- Covers repair damages caused by vandalism, car break-ins, and car theft

Read more: 5-Tips to Kick Start your Digital Marketing Career

Collision Coverage

As one of the most common and important types of car insurance, collision coverage will protect your car against physical damage. Remember, a collision can cause severe damage to your vehicle. It can result in damages that cost hundreds of dollars in terms of repairs. Common causes of collision include falling trees, other cars, poles, as well as a guardrail.

If you need to purchase collision coverage, then you will need to go for basic coverage as well. Remember, this type of coverage can only be purchased alongside liability and comprehensive coverage. Do your research. Get an insurance quote from moneyexpert.com car insurance quotes.

The Bottom-Line

Understanding the features of comprehensive and collision insurance policies is important when it comes to protecting your car. Remember, each of these two options comes with distinctive features. Plus, they have different advantages and disadvantages. The above article has highlighted these features, pros, and cons of each option—helping you make a wise decision.