QuickBooks Self-Employed is bookkeeping programming intended for self-employed entities using QuickBooks. Its highlights incorporate invoicing, impose computations, cost and time following, and records compromise.

It is a small business accounting software intended for independently employed people who are required to record a Schedule C, for example, specialists, real estate agents, Uber drivers, and autonomous advisors.

In any case, QuickBooks Self-Employed still has the best approach as the product has a few holes. No doubt, QBSE gets most of the attention from freelancers, but QuickBooks Online also has three other packages catering to small businesses as well.

Features

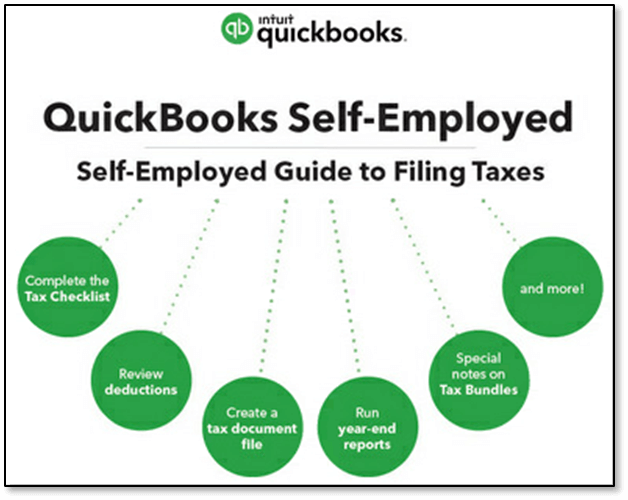

QuickBooks Self-Employed is charge programming with a couple of light accounting devices added to the blend. For the normal specialist, these highlights are very encouraging; for individuals needing full bookkeeping capacities, QuickBooks Self-Employed probably won’t cut it. Here’s a diagram of the highlights you can expect with QuickBooks Self-Employed:

Dashboard: QuickBooks Self-Employed has a delightful UI. The recently structured dashboard incorporates six diagrams to give you a continuous take a gander at your business’ budgetary state, including your Profit and Loss, Expenses, Accounts, Invoices, Mileage, and Estimated Taxes. Tabs on the left-hand side of the screen make it simple to explore different highlights.

Invoicing: QuickBooks Self-Employed gives fundamental invoicing. You can receipt continuously, by thing, or by a level rate. There is no contact the executives or stock in QuickBooks Self-Employed, however, the product will recollect past receipt data and let you select past contacts and things from inside the receipt. There is no receipt customization, no business assess bolster, and no evaluations include. Be that as it may, you can add your logo to your solicitations.

Advantages of QuickBooks Self Employed

Clients who gave QuickBooks Self-Employed a positive survey like that it is packaged with TurboTax, so they don’t need to stress over accounting assignments. Others additionally welcome that it has an Android application.

QuickBooks Self-Employed (QBSE) makes it simple for me to monitor all my business’ accounts, from the site application to the Android application. It’s a basic enough task to classify pay and costs, which are then consequently brought into the TurboTax application toward the finish of the duty year.

Pros

- Suited for freelancers

- Good tax support

- TurboTax integration

- Well-designed UI

Disadvantages of QuickBooks Self Employed

Clients who gave QuickBooks Self-Employed a negative audit said that it does exclude finance usefulness. Others referenced that its bookkeeping highlights are essential and restricted.

Cons

- No state tax support

- Limited invoice features

- Unscalable

Hardware & Software Requirements

QuickBooks Self-Employed is compatible with nearly any computer having an internet connection as cloud-based software, except for Linux. Along with this, it also has mobile apps available for Apple products (IOS 10.0+) as well as Androids (5.0+).

QuickBooks Self-Employed Pricing

QuickBooks Self-Employed has two evaluating choices: one that is simply QuickBooks Self-Employed and another that is packaged with QuickBooks TurboTax. All alone, the product costs $10 every month. Whenever packaged with Turbotax, it costs $17 every month. The primary distinction between the plans is access to sending out Schedule C* derivations into their TurboTax Self-Employed component.

The plans are mentioned as:

- QuickBooks Self-Employed

- QuickBooks Self-Employed Tax Bundle

Self-Employed

- $10/month

- Track income and expenses

- Separate business and personal expenses

- Record tax deductions

- Calculate estimated quarterly taxes

- Schedule C forms

- Invoicing

- One user, plus one accountant

Self-Employed Tax Bundle

- $17/month

- Track income and expenses

- Separate business and personal expenses

- Record tax deductions

- Calculate estimated quarterly taxes

- Schedule C forms

- Invoicing

- TurboTax integration

- Pay quarterly estimated taxes online

Customer Service & Support

QuickBooks is commonly infamous for poor client bolster, and in spite of the fact that QuickBooks Self-Employed is missing telephone bolster, QBSE is endeavoring to think outside the box and offer better than average, brisk help choices. There is another work in live visit include that is amazingly useful. The assistance focus has likewise been pleasantly rearranged. Here are the client bolster choices in more detail:

Live Chat: This new implicit live talk highlight is a standout amongst the best help alternatives accessible. Delegates are commonly useful. This is likely the quickest, most direct type of help.

Contact Form: You can contact QuickBooks Self-Employed by rounding out an in-programming bolster shape. Answers are moderately snappy, generally taking around an hour or somewhere in the vicinity.

Help Center: QuickBooks Self-Employed has an assistance focus called Learn and Support that has articles on different highlights in the product like beginning, assessments, and that’s only the tip of the iceberg.

Independent venture Center: The QuickBooks private company focus highlights counsel on different independent venture points including bookkeeping, charges, income, and then some.

QuickBooks Blog: QuickBooks has a blog that highlights updates and news for all QuickBooks items, albeit the vast majority of the articles relate to QuickBooks Online.

Internet-based life: Intuit looks after Facebook, Twitter, and Linked records for the majority of their QuickBooks items on the whole.

QuickBooks Self-Employed Alternatives

Not certain if QuickBooks Self-Employed is an ideal choice for you? Peruse our surveys of all best bookkeeping programming suppliers or look at one of these three QuickBooks Self-Employed contenders.

- Xero

- FreshBooks

- Billy

When to Use QuickBooks Self-Employed

All in all, QuickBooks Self-Employed will work for people or organizations that meet the accompanying criteria:

- Documents a Schedule C with Form 1040

- Pays greater part of costs utilizing a charge card, Mastercard or money

- Composes close to five checks for each month

- Solicitations close to 10 clients for each month

- Does not have any workers Does not utilize any contractual workers

Outcome

Giving instruments to the independently employed is an outstanding undertaking. Consultants who don’t have past business encounter as well as self-employed entities who need to ascertain assessed quarterly charges alone are in colossal need of what this product gives.

In the event that you are a specialist without any representatives or temporary workers, QuickBooks Self-Employed was made for you. You can agree to accept the standard form and after that move up to the TurboTax package at whatever point you’re prepared.